Entrepreneurs abound in today’s world!

Starting a business is exciting — but it’s also full of decisions that can make or break your future success.

From entity selection to financial planning, the early moves you make are critical.

At Essistant KC, we work closely with new business owners and entrepreneurs to lay a strong financial foundation. Here’s why consulting with an expert early on can change everything:

Choosing the Right Entity Type

Sole proprietor, LLC, S Corp — which one is right for you?

Each has major tax and liability implications. We guide you through the options to pick the structure that protects you and maximizes your profits.

Setting Up Smart Systems from Day One

Payroll, bookkeeping, invoicing — setting up the right systems early saves you time, money, and headaches later. We help you avoid costly mistakes and get organized from the start.

Creating a Realistic Financial Plan

A dream without a plan is just a wish. We help you create a business plan, build financial projections and budgets so you know what’s realistic — and what it takes to hit your goals.

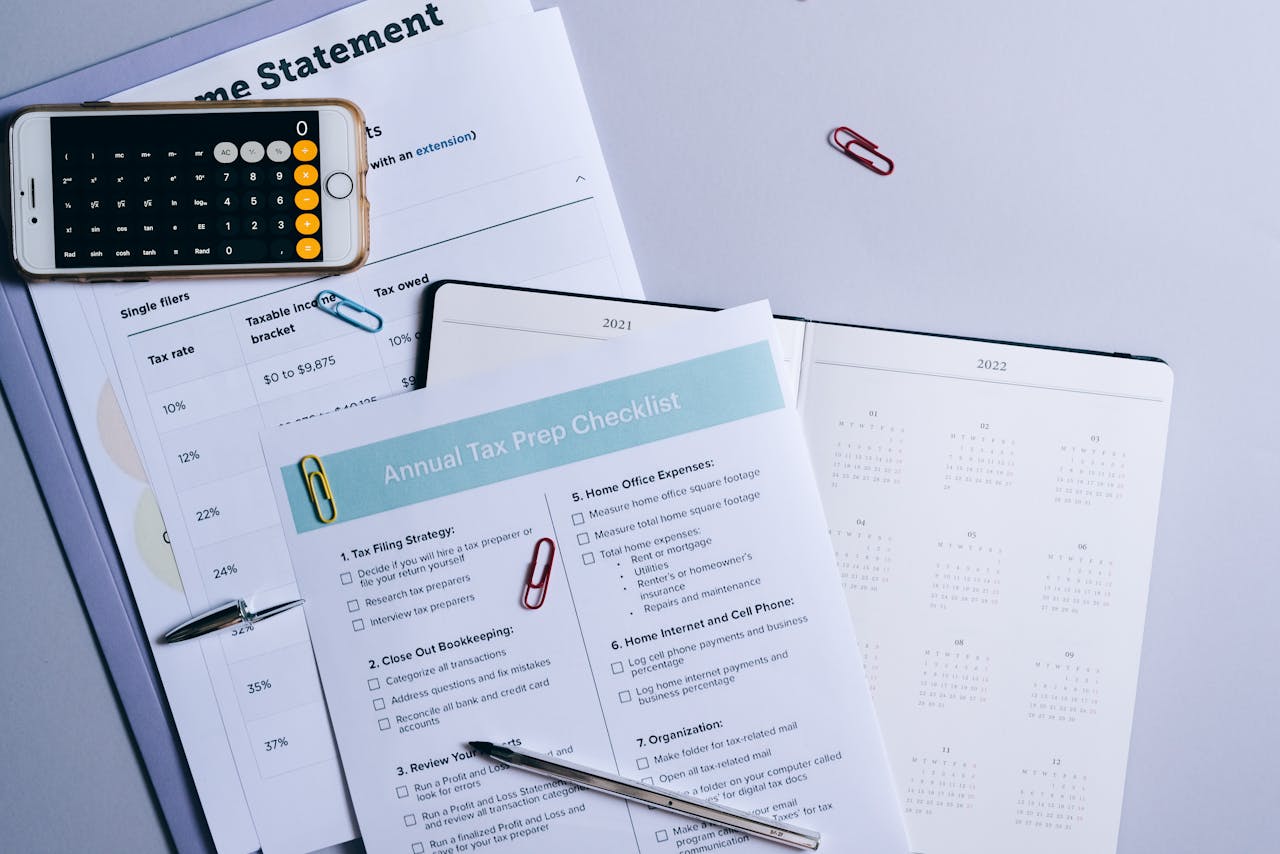

Understanding Compliance Requirements

From local business licenses to tax registrations, there’s a lot to keep track of. We make sure you stay compliant so you can focus on building your business.

The Bottom Line:

Entrepreneurship is a bold move — but you don’t have to do it alone.

Let Essistant KC be your trusted financial guide every step of the way.